Your Auto Insurance Policy Is Changing

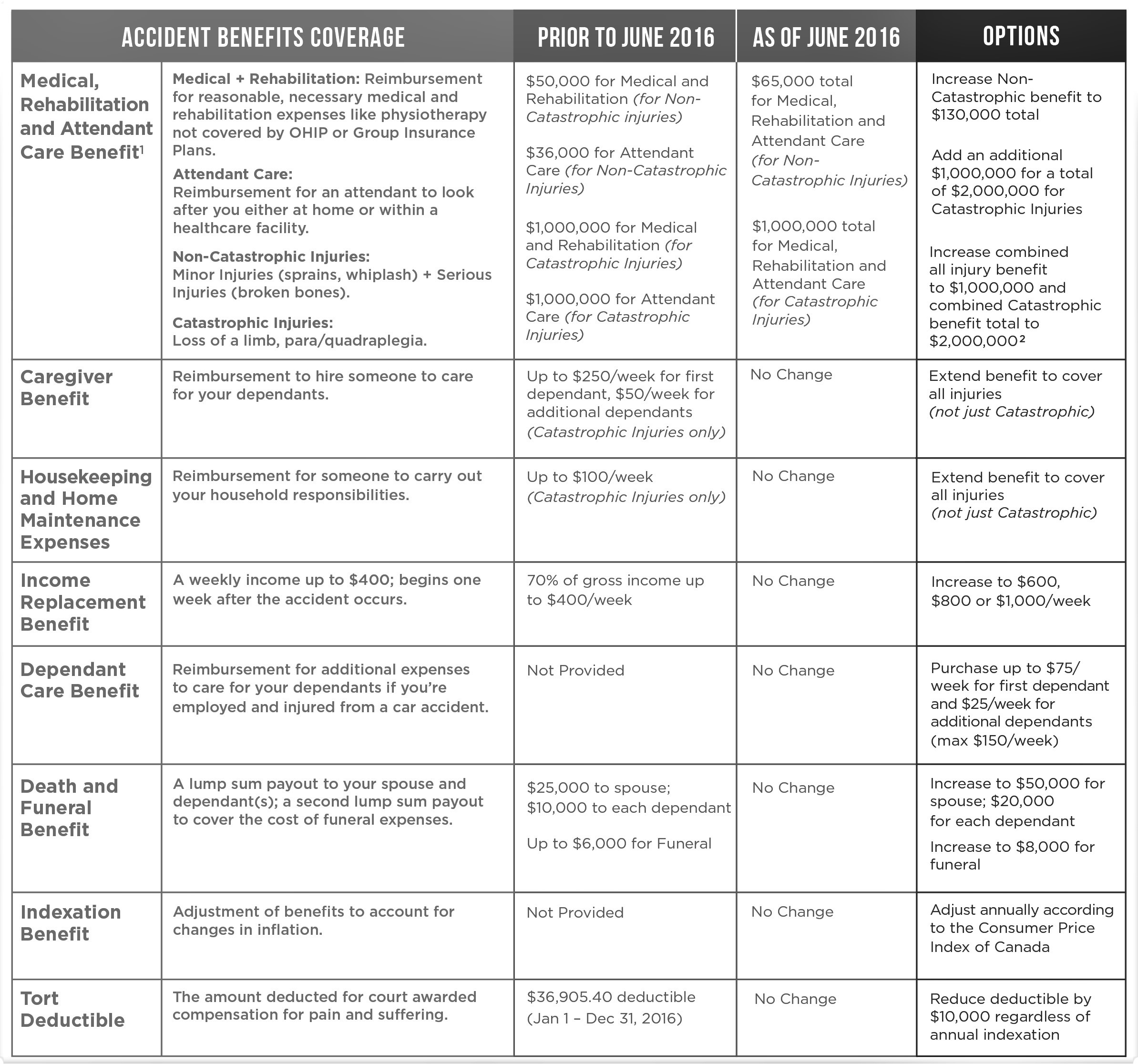

Your Ontario auto insurance benefits are changing to make your premiums more affordable and provide you with greater choice. Many of the changes affect the accident benefits you would receive if you were injured in a collision. Some benefit limits have been reduced, and some of the options for increased coverage have been changed or eliminated.

If you renew or buy a new policy on or after June 1, 2016, it will automatically default to the new reduced benefits limits unless you purchase additional coverage.

Here’s what’s different in benefits limits:

What do the changes mean?

To reduce premiums, the Government of Ontario has introduced reforms to help reduce consumer costs and improve the system. These reforms ensure Ontarians have access to the treatments and benefits they need to recover from injuries caused by a collision.

A key component of these reforms is more choice. The catastrophic impairment benefit will provide up to $1 million for combined medical, rehabilitation and attendant care. There is also an option to buy up to $2 million for this benefit, and the amount can be increased to $3 million when combined with the $1 million optional medical/rehabilitation benefit for all injuries. For less serious injuries, a maximum of $65,000 will be available in standard coverage for combined medical/rehabilitation and attendant care.

How does this compare to other provinces? In Alberta and the Maritimes, the maximum combined medical/rehabilitation benefit for all types of injuries is $50,000.

There is a new option to buy up to $130,000 in standard medical/rehabilitation and attendant care coverage or up to $1 million in added coverage.

Ontario will continue to apply a $3,500 cap for minor injury awards. The cap includes the $2,200 that is pre-approved and available over 12 weeks.

For more information contact your insurance representative.

Source: Insurance Bureau of Canada

What do the changes mean?

To reduce premiums, the Government of Ontario has introduced reforms to help reduce consumer costs and improve the system. These reforms ensure Ontarians have access to the treatments and benefits they need to recover from injuries caused by a collision.

A key component of these reforms is more choice. The catastrophic impairment benefit will provide up to $1 million for combined medical, rehabilitation and attendant care. There is also an option to buy up to $2 million for this benefit, and the amount can be increased to $3 million when combined with the $1 million optional medical/rehabilitation benefit for all injuries. For less serious injuries, a maximum of $65,000 will be available in standard coverage for combined medical/rehabilitation and attendant care.

How does this compare to other provinces? In Alberta and the Maritimes, the maximum combined medical/rehabilitation benefit for all types of injuries is $50,000.

There is a new option to buy up to $130,000 in standard medical/rehabilitation and attendant care coverage or up to $1 million in added coverage.

Ontario will continue to apply a $3,500 cap for minor injury awards. The cap includes the $2,200 that is pre-approved and available over 12 weeks.

For more information contact your insurance representative.

Source: Insurance Bureau of Canada